Challenges and Engagements in Working with Non-Delegated Municipalities in Gauteng

This report discusses the challenges faced by Gauteng Provincial Treasury in overseeing non-delegated municipalities like City of Johannesburg and City of Tshwane. While there are existing working relationships and engagements with National Treasury for support and monitoring, there are still complexities in providing oversight for these metropolitan municipalities due to their size and operations. Current engagements include GRAP training, internal audit workshops, clean audit initiatives, government debt support, conditional grants management, and more. The report highlights the need for closer monitoring and support structures for improved governance in the future.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Working With Non-Delegated Municipalities Gauteng Provincial Treasury March 2021

Non Delegated Municipalities in Gauteng The term stems from MFMA Circular 20 which deals with the delegations by the National Treasury to Provincial Treasuries. Non-Delegated municipalities are the Metropolitan (Category A) municipalities and the Secondary Cities (bigger municipalities). In Gauteng the Non-delegated municipalities are the City of Johannesburg, City of Tshwane and the City of Ekurhuleni. Emfuleni Local municipality at one stage was a shared municipality due to its size as it is the biggest local (Category B) municipality in South Africa. Due to the complexities in the operations of the metropolitan as well as the size of the municipalities, the Gauteng Provincial Treasury does not have the required capacity to adequately provide oversight and support these municipalities. The Gauteng PT is in the process of adopting a new more capacitated organisational structure, which if fully implemented could result in closer monitoring over metropolitan municipalities. The National Treasury is however doing very well with its oversight over the metros.

Status Quo and Possible Challenges We currently have a good working relationship with the National Treasury and joint work to monitor and support the non-delegated municipalities. Under the Budgets and s71 reporting issues, consolidated reporting is available but not always have a consolidated view on other general areas of MFMA Compliance. The Gauteng PT however participates in the CFO Forum for Non delegated municipalities led by NT, whilst metros representation at the Gauteng PT CFO Forum meetings are also very good. There are difficulties in knowing the real issues and challenges as we are not active in metros but there are expectations to report for all municipalities. COGTA in Gauteng work with all the municipalities, not just with the delegated municipalities. The same may be true for SALGA.

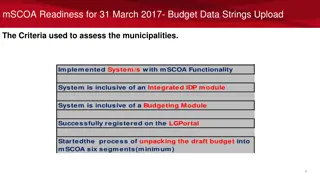

Current Engagements with Metropolitans GRAP training provided to all, including metros. Internal audit workshops and training provided to all, including metros. Operation Clean Audit engagements attended by all municipalities. Government Debt Support to all municipalities, including metros. Conditional Grants Management Support to all municipalities, including metros. Reviews done on the Borrowing Proposals of all, including the metros. MSCOA support provided to metros by the National Treasury.

The End The End